Advanced Research

How to Evaluate Market Research Vendors for Global Reach

Team Remesh

February 10, 2026

Market Research

Articles

Advanced Research

How to Evaluate Market Research Vendors for Global Reach

Team Remesh

February 10, 2026

Market Research

Articles

Advanced Research

3 Early-Stage Research Methods to Gather Consumer Insights

Team Remesh

January 27, 2026

Market Research

Articles

Advanced Research

3 Early-Stage Research Methods to Gather Consumer Insights

Team Remesh

January 27, 2026

Market Research

Articles

.avif)

Advanced Research

Why Agencies Should Embrace AI Tools for Market Research

Team Remesh

January 26, 2026

Articles

.avif)

Advanced Research

Why Agencies Should Embrace AI Tools for Market Research

Team Remesh

January 26, 2026

Articles

Advanced Research

The Top Market Research Companies for the CPG Industry

Team Remesh

January 20, 2026

Market Research

Articles

Advanced Research

The Top Market Research Companies for the CPG Industry

Team Remesh

January 20, 2026

Market Research

Articles

Advanced Research

The Most Cutting-Edge Consumer Insights Software of 2026

Team Remesh

January 5, 2026

Market Research

Articles

Advanced Research

The Most Cutting-Edge Consumer Insights Software of 2026

Team Remesh

January 5, 2026

Market Research

Articles

Research 101

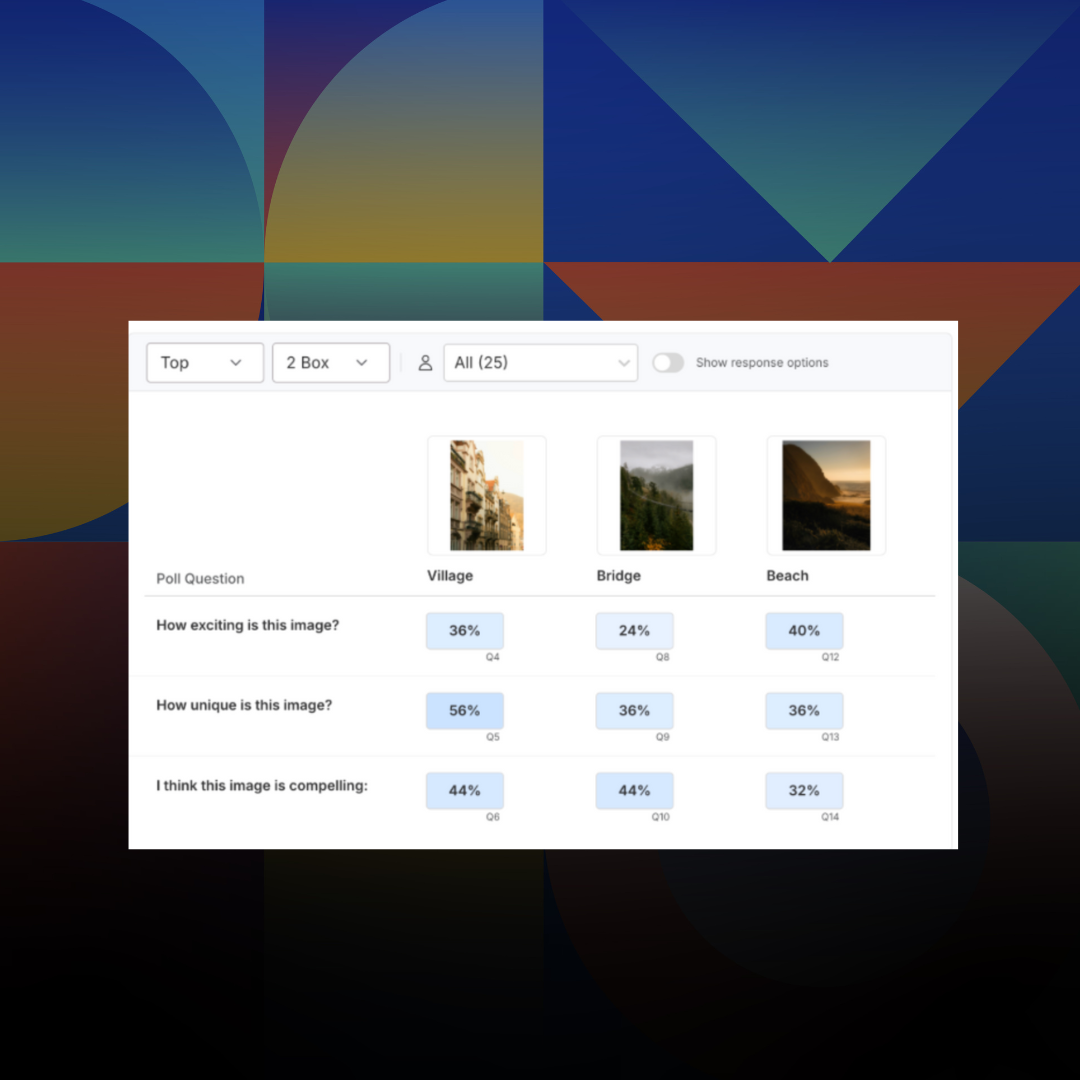

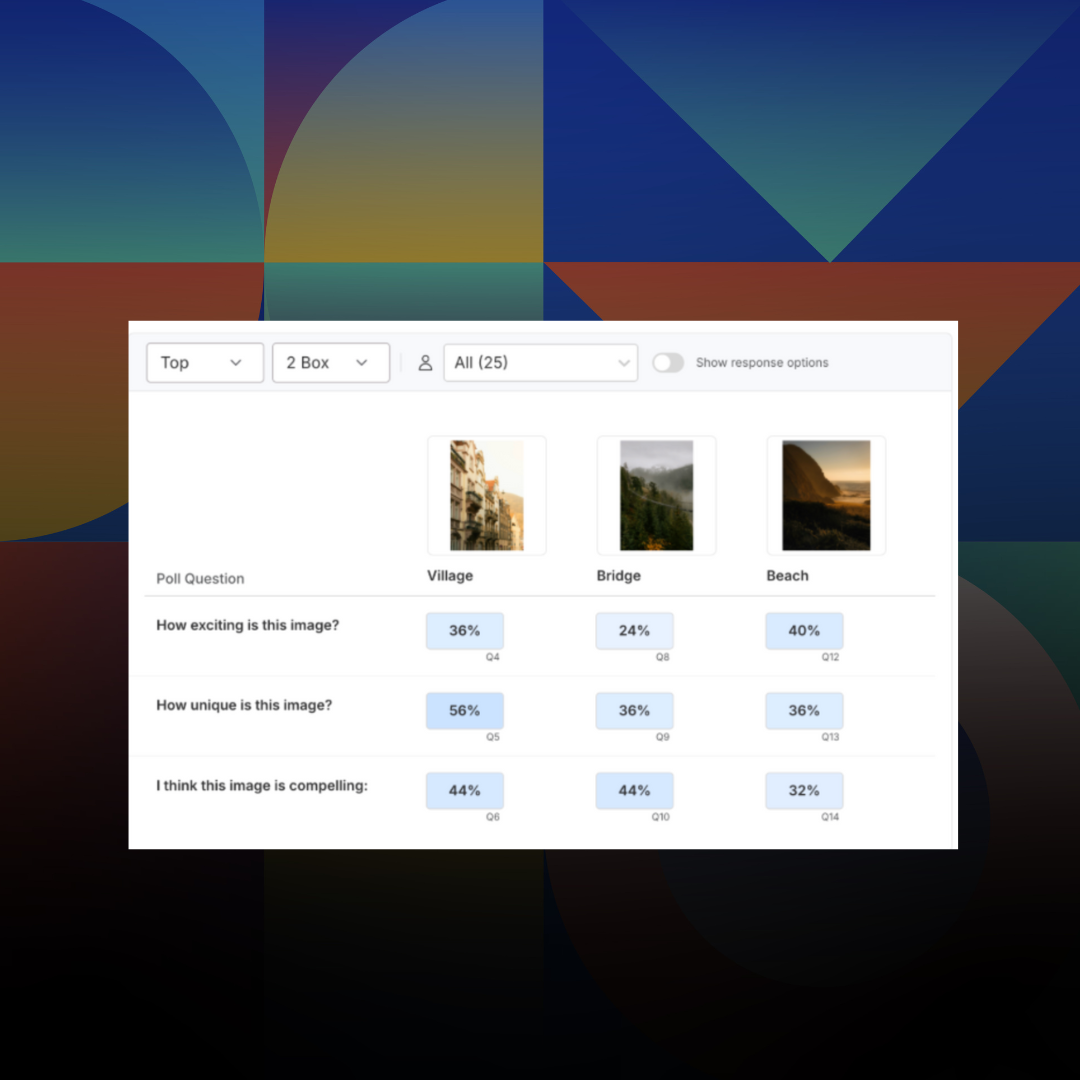

Introducing: Poll Comparison - Streamline Concept Testing and Make Better Decisions Faster

Emmet Hennessy

November 24, 2025

Market Research

Articles

Research 101

Introducing: Poll Comparison - Streamline Concept Testing and Make Better Decisions Faster

Emmet Hennessy

November 24, 2025

Market Research

Articles

AI

Purpose-Built for Research AI is Here - a Letter from the CPO

Jessica Dubin

October 21, 2025

Market Research

Articles

AI

Purpose-Built for Research AI is Here - a Letter from the CPO

Jessica Dubin

October 21, 2025

Market Research

Articles

Advanced Research

Unlock Agile Global Insights: Using Remesh Multi-Language Conversations for Research Across Audiences

Customer Success Team

October 14, 2025

Market Research

Articles

Advanced Research

Unlock Agile Global Insights: Using Remesh Multi-Language Conversations for Research Across Audiences

Customer Success Team

October 14, 2025

Market Research

Articles

The Ultimate Guide to Virtual Qualitative Research

In this guide, you'll learn how to conduct online qualitative research and how to transition to this method.

What is Qualitative Research?

Qualitative research, according to the SAGE Handbook of Qualitative Research, is defined as a situated activity that locates the observer in the world. This interpretive practice turns the world into a series of representations. The representations can include field notes, interviews, conversations, photographs, recordings, and memos to the self. Qualitative researchers study things in their natural settings, attempting to interpret phenomena in terms of the meanings people bring to them.

In this guide, you'll learn how to conduct online qualitative research and how to transition to this method.

Often thought of through the lens of impressions, opinions, and views, qualitative research brings depth to data collection analysis by providing context and customer insight to confirm a hypothesis.

Due to its open-ended nature, qualitative data may be more complex to analyze than quantitative data. Being agile, innovative, and relevant requires that modern mixed methods researchers practice both quant and qual methods in their projects, especially in transitions to online qualitative research.

Read: The Impact of COVID-19 on Research (Report)

Types of Online Qualitative Research Methods

In general, there are six types of approaches to qualitative research. These include the phenomenological model, the ethnographic model, grounded theory, case study, historical model, and the narrative model.

Although there are a number of qualitative approaches to research, this article will explore types of the ethnographic research model and grounded theory, which are the easiest to conduct in an online environment. These online qualitative research methods include in-depth interviews, observational research, and open-ended surveys. For more detailed information on other types of qualitative research, we strongly recommend reading from a selection of market research journals offered by Sage Publications.

One-on-one Interviews

Individual interviews with a single participant can provide the opportunity for detailed conversations about a specific topic.

Interviews can be conducted in person (which provides the added benefit of understanding consumers through audio and visual cues). Researchers can also conduct interviews on meeting platforms such as Zoom or Microsoft Teams to collect data at home. In a lightly structured interview, you also have the flexibility to adapt and probe into anything interesting interviewees might say.

More formal video-based research tools like Plotto allow asynchronous data collection. These proper video-based research tools typically provide a survey's benefits, while maintaining your target audience's essential thoughts and experiences.

Plotto interface

Truly unique online qualitative research is also readily available via social media. This idea is particularly true for video-based platforms like Tik Tok and Instagram Stories. These platforms allow for passive, secondary data collection and tend to act as trend analytics providers.

Individual interviews act as the qualitative data sources necessary to execute a thematic analysis. These allow you to view your product through a customer’s eyes and understand buying motivation.

Trying using these prompts for customer interviews:

- What solutions did you try before using our product?

- What is your favorite feature of our product?

- How do you envision using this product into your daily life?

Read: 100 Open-ended Research Questions (Blog)

Focus Groups

Researchers can also gather data that is useful for qualitative data analysis from large amounts of consumers or employees by providing a comfortable environment for discussion, aka focus groups.

Influential focus groups stimulate spirited discussion among participants. Spirited discussion enables members to bounce off one another’s ideas and produce new thinking for more in-depth discussions. But how can this same dynamism be translated online?

According to a Remesh study on the impact of COVID-19 on research, several market research experts are hesitant that new or online methodologies will provide accurate output. Although this is a valid concern, online research can provide the same quality of data as other more conventional methods.

Sometimes, these online methods can even have added benefits, like decreasing the likelihood of groupthink.

Online focus groups are synchronous chat room-style platforms that can easily replace in-person focus groups. Virtual focus groups are unique in that they allow participants to be anonymous, which is proven to reduce bias.

Remesh is one example of an online focus group, which uses AI to enable a conversation between one moderator and 1,000 participants.

Online focus groups like this offer the advantage of participant diversity across geographic boundaries. Online focus groups also cut travel costs.

Remesh participant interface (mobile)

But will an online focus group serve your research objective? Some of the pros include:

- Anonymous participant observations and responses

- Increased demographic diversity

- Cost-efficient

- Increased speed to insights (primarily when AI is implemented)

While there are some drawbacks to online focus groups (like the inability to observe body language), the choice is mainly dependent upon your budget and your research needs.

Probe research questions and follow-up discussion questions can include:

- When you see our brand logo, what thoughts come to mind?

- What do you notice first about this design?

- How did you feel when you saw this advertisement?

- Would you find Product X helpful? Why or why not?

- Do you foresee any problems with using Product X?

- What do you like best about product X?

- If you could add any feature to Product X, what would it be?

Sourcing Your Audience (i.e. Participants)

Maybe you already have an online focus group platform in mind, but your team is scrambling to identify the right audience. Or, you're unsure if participants will show up at all.

If you don't have access to a participant community, we recommend reaching out to panel research providers like NetQuest. These services source audiences and handle incentives. Other resources like ProdegeMR provide unique supplemental quantitative data from participants like shopper receipt data and location tracking.

Read: The Impact of COVID-19 on Research (Report)

Observational Research

While focus groups are a robust research method, decision recall is most potent when a customer is actively purchasing a product.

For example, observing a customer react to your product at a store allows you to measure their behavior first-hand. This provides an excellent opportunity to watch a customer compare a competitor's product in-store. Or, to witness which product container or ad catches a customer’s eye. Luckily, mobile ethnography is a simple way to reproduce this method from afar.

One excellent example of this method in action is from strategic insights expert Kelsy Saulsbury and her work at Hallmark.

In the video below, Saulsbury describes a campaign when she asked customers for photos of family traditions involving holiday Hallmark items. Using that content made by users, she performed a content analysis. She segmented the content by emotion recognition, location, brand logo visibility, image type, and geo-location. To discover how Saulsbury turned that segmentation into actionable insights, watch the full video below!

In addition to mobile ethnography, researchers can utilize online observation to understand customers or employees. User session replay tools, for example, can map user and customer behavior on websites or within platforms. FullStory is most applicable for:

- finance (clarifying UX confusion)

- retail (pinpointing where sales are made and lost)

- SaaS (increase stickiness within an app)

Because this method requires little human interaction (in most cases), it's one of the most unobtrusive types of qualitative research methods. However, UX agencies do exist which specialize in this methodology.

Participant Observation

Participant observation is a unique case where a researcher might participate in a study rather than just observe. Because it's impractical to study an entire population, random sampling allows researchers to gather results from a subset of a population. This study is the most common ethnography case and is considered field research conducted in natural settings. However, virtual environments can still enable this type of qualitative research.

Although participant observation can provide rich insights into consumer opinions and behavior, market researchers must ensure they follow ethical guidelines. Participants must know, for example, that they are involved in a research study where field notes are recorded. In a virtual setting, they must also be alerted if they record the study or if additional researchers observe.

Quantitative vs. Qualitative Research

How do quantitative and online qualitative research methods differ? Think of these two types of research as providing different insights at various stages of an innovation cycle.

The pros of qualitative research include:

- the ability to understand a complex subject

- ask open-ended research questions

- the yield of rich, insightful data with underlying patterns

- a reasonable budget for any team or need

- quality over quantity

The cons of qualitative research include:

- use of more extended interviews rather than short surveys

- extensive pre-planning

Types of Qualitative Research Applications for Product Innovation

So your company wants to take advantage of qualitative research and leave quant in the dust. Here are a few ways to take advantage of that method type. For even more ideas, check out our qualitative research case studies.

Foundational Research

Qualitative research helps you discover problems or opportunities in your customer’s mind. Those ideas can become hypotheses to be proven through quantitative research.

NASCAR used Remesh to conduct foundational research about super-fans across the country after changing the Daytona 500. They spoke to 200 super-fans about the new race structure and what made fans excited to watch in general. NASCAR was able to conduct the online focus group during a race and capture the fan engagement simultaneously. That's something that would have been impossible with in-person research considering the geographic constraints.

Hypotheses Validation

Quantitative market research provides statistically significant variables to validate your hypotheses. Qual is best suited when your customers’ pain points are highly subjective. Even if two customers have the same problem, the underlying cause(s) of that problem could differ significantly.

Jane.com, an e-commerce fashion site, used FullStory to accomplish that objective. Notably, the brand was interested in UX issues that might disrupt a smoother customer experience from discovery to purchase. Using the user experience replay tool, Jane.com discovered a problem with their password reset workflow. The team realized that’s what was discouraging initially eager customers from viewing their virtual carts.

Pre-launch Product Research

Preparing for your product launch is a great time to gather unbiased feedback on features, usability, and research design. At this juncture, it's crucial to conduct market research to understand any unforeseen drawbacks of a product. That way, teams can resolve the issues surrounding the communication, packaging, or positioning of your product before launch.

Understanding customer reactions will reveal which benefits are most important to emphasize in marketing and developing your product.

Zoom is a viable option for collecting qualitative data because it's familiar and because it’s cost-effective. It’s also a preferred method for participants compared to in-person interviews, telephone, and other video conferencing platforms.

Many participants also find Zoom to be helpful in forming and maintaining rapport with a researcher. Especially when compared to “non-visual” communication mediums such as telephone or e-mail.

Post-launch Product Feedback

You’ve gone through the development process, and now your product’s made it to the market. What can you do to complete the feedback loop with your customers?

After the launch, focus your market research on identifying confusion or issues that might prevent people from buying your product. Link up with sales and support teams to understand questions that customers often raise. Or, sit in on sales calls to hear follow-up questions asked after a demo. These constitute unfiltered qualitative feedback - that includes reliability and validity - and are heard first-hand from the customer.

According to Nielsen, 63 percent of customers like it when manufacturers offer new products.

For online quantitative research, BrandWatch can provide insight into how visitors use your site or engage in campaigns and messaging. Work with your research team to conduct user tests of your page. Or carry out surveys such as customer satisfaction surveys to understand end-users reactions to your product.

Read: Transitioning to Online Research (Report)

Summing Up Qualitative Research

Effective market research is often constituted by an intricate hybrid of qualitative and quantitative research at the right moments. Combine the numerical data and statistical significance of quantitative studies with the depth of insight that qualitative research methods provide - and there’s a strong market research strategy.

Psst... if you enjoyed this guide, our market research pro-tips are right up your alley! Check out our guide on cutting-edge research methodology and the current state of the market research industry in 2020. {{cta('4924012b-eaba-41b9-87de-f1de423074bb')}}

-

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh et justo cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere.

-

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh et justo cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere.

-

More

Stay up-to date.

Stay ahead of the curve. Get it all. Or get what suits you. Our 101 material is great if you’re used to working with an agency. Are you a seasoned pro? Sign up to receive just our advanced materials.

.png)

.png)

.png)

.png)